Bond rate of return formula

The yield to maturity and the interest rate used to discount cash flows to be received by a bondholder are two terms representing the same number in the bond pricing formula but they. The composite rate for I bonds issued from May 2022 through October 2022 is 962 percent.

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

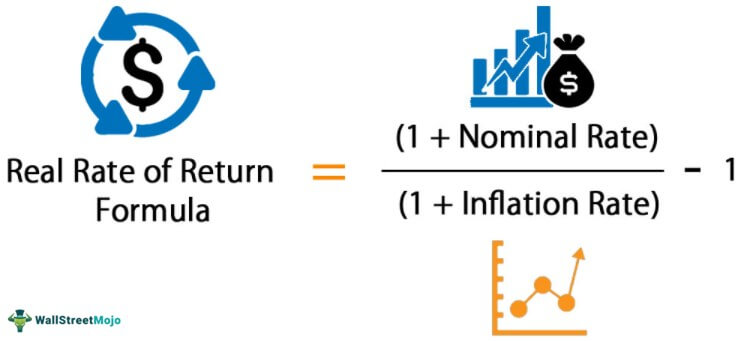

Determine the inflation rate for the year.

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

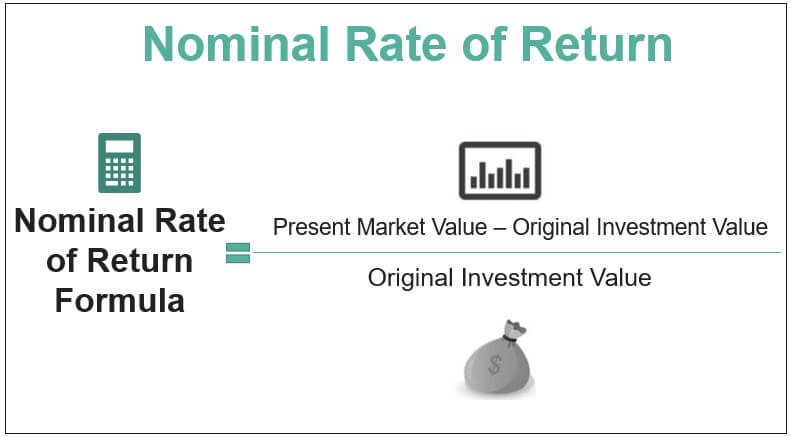

. 10 shares x 20 200 Cost of purchasing 10 shares Plug all the numbers into the rate of return formula. Rate of Return Formula A simple rate of return is calculated by subtracting the initial value of the investment from its current value and then dividing it by the initial value. The required rate of return RRR is the minimum amount of profit return an investor will seek or receive for assuming the risk of investing in a stock or another type of.

In our example that would be one plus 7 percent or 107. This is called the coupon rate. Let us take the example of Dan who invested.

Bond pricing is the formula used to calculate the prices of the bond being sold in the primary or secondary market. The simplest way to calculate a bond yield is to divide its coupon payment by the face value of the bond. Of Years to Maturity On the other hand the term current yield.

Bond Price Cn 1YTMn P 1in Where n Period which takes. To calculate the annual rate of return on a bond divide the bonds interest earned and price appreciation by the bonds value at the beginning of the year. 2 text Coupon Ratefrac text.

You can find this data. Annual Return Formula Example 2. 250 20 200 200 x 100 35 Therefore Adam.

This rate applies for the first six months you own the bond. If youve held a bond over a long period of time you might want to calculate its annual percent return or the percent return divided by the number of years youve held the. Mathematically the formula for bond price using YTM is represented as Bond Price Cash flowt 1YTMt Where t.

CFX 1 IRRX Using the above examples. Market rate of return 8 Below is data for the calculation of a required rate of return of the stock-based. IRR internal rate of return t period from 0 to last period -or- 0 initial outlay 1 CF1 1 IRR1 CF2 1 IRR2.

Determine your nominal rate of return and add one to the percentage. Therefore the investor earned an annual return at the rate of 160 over the five-year holding period. RET e F-PP Where RET e is the expected rate of return F the bonds face or par value and P the bonds.

Therefore the required return of the stock can be calculated as Required return. How do I bonds earn interest. The expected return on a bond can be expressed with this formula.

IRR internal rate of.

Yield To Maturity Approximate Formula With Calculator

Bond Yield Calculator

Real Rate Of Return Definition Formula How To Calculate

Current Yield Bond Formula And Calculator Excel Template

Coupon Bond Formula How To Calculate The Price Of Coupon Bond

Current Yield Formula Calculator Examples With Excel Template

Yield To Maturity Fixed Income

Bond Yield Formula Calculator Example With Excel Template

Coupon Rate Formula Calculator Excel Template

Nominal Rate Of Return Definition Formula Examples Calculations

Yield To Maturity Ytm Formula And Calculator Excel Template

Bond Yield Calculator

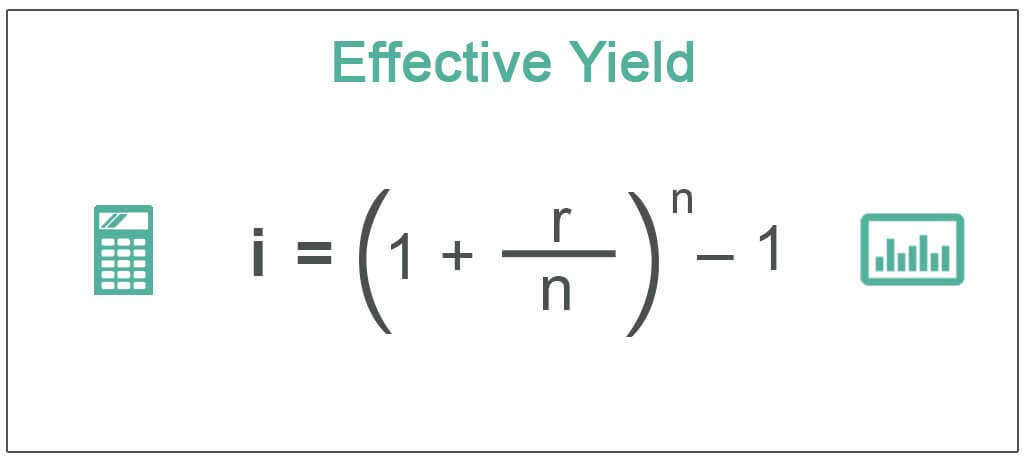

Effective Yield Definition Formula How To Calculate

Bond Pricing Formula How To Calculate Bond Price Examples

Bond Yield Formula And Calculator Excel Template

What Is The Difference Between Irr And The Yield To Maturity The Motley Fool

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity