Health insurance payroll deduction calculator

Choose the Payroll Item button and click New. 24 Paychecks In this method Zenefits calculates deductions for bi-weekly employees as if they were semi-monthly 24 pay dates in a year so that monthly.

How To Calculate Payroll Taxes Wrapbook

You can enter your current payroll.

. So before withholding any taxes deduct 300 for the pre-tax health insurance. Choose Deduction and click Next. Free Unbiased Reviews Top Picks.

It will confirm the deductions you include on your. Edit Sign and Save Payroll Deduction Agrmt Form. Payroll Deductions Calculator Use this calculator to help you determine the impact of changing your payroll deductions.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Health Insurance POP etc. Determine your taxable income by deducting pre-tax contributions Withhold.

2022 Federal income tax withholding calculation. This Payroll Deductions Calculator will help you to determine the impact that changing your payroll deductions can have on your financial situation. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T.

Say Ricky earns 1000 per pay period in gross wages earnings before paycheck deductions. This calculator uses the 2016. Ad Web-based PDF Form Filler.

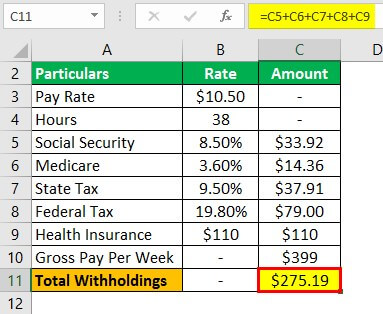

Ad Compare This Years Top 5 Free Payroll Software. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Assume that the cost of a companys health insurance plan is 300 per biweekly pay period and that the employee is responsible for paying 25 of the cost through payroll withholding.

2000 300 1700 After deducting the health insurance premiums the employees pay is. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. All Services Backed by Tax Guarantee.

Select Custom Setup and click Next. Go to the Lists menu and select Payroll Item List. 2022 Federal income tax withholding calculation.

Ad Explore Plans From 1300 Small Business Health Insurance Plans From 70 Carriers. Subtract 12900 for Married otherwise. You can enter your current payroll information and deductions and.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Its a simple four-step process. Try changing your withholdings filing status or retirement savings and let the payroll deduction calculator show you the impact on your take home pay.

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Payroll Deductions Calculator Use this calculator to help you determine the impact of changing your payroll deductions. Download or Email Form 2159 More Fillable Forms Register and Subscribe Now.

You can enter your current payroll information and deductions and then compare them to your. Taxpayers can choose either itemized deductions or. Subtract 12900 for Married otherwise.

A paycheck calculator allows you to quickly and accurately calculate take-home pay. Use this calculator to help you determine your net paycheck. He contributes 30 per pay period for health insurance costs.

All Services Backed by Tax Guarantee. The standard deduction dollar amount is 12950 for single households and 25900 for married couples filing jointly for the tax year 2022. Use this calculator to help you determine the impact of changing your payroll deductions.

Small Business Health Insurance Is Complicated eHealth Is Here to Help. Ad Payroll So Easy You Can Set It Up Run It Yourself. You can enter your current payroll information and deductions and.

Paycheck Calculator Take Home Pay Calculator

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Payroll Tax What It Is How To Calculate It Bench Accounting

Are Payroll Deductions For Health Insurance Pre Tax Details More

How To Calculate Federal Income Tax

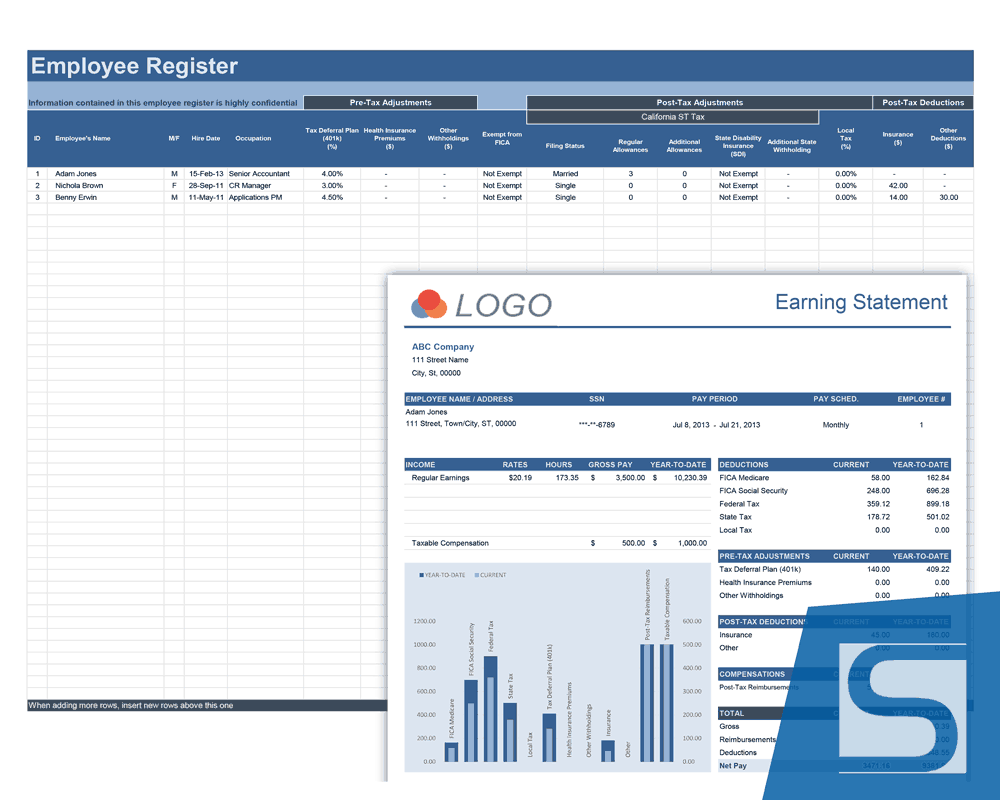

Payroll Calculator With Pay Stubs For Excel

Payroll Calculator With Pay Stubs For Excel

Payroll Tax Calculator For Employers Gusto

Solved W2 Box 1 Not Calculating Correctly

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Payroll Formula Step By Step Calculation With Examples

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Formula Step By Step Calculation With Examples

How To Calculate Medical Deductions In Payroll

How To Calculate Payroll Taxes In 5 Steps

Paycheck Calculator Take Home Pay Calculator

Payroll Calculator With Pay Stubs For Excel